Table of Contents

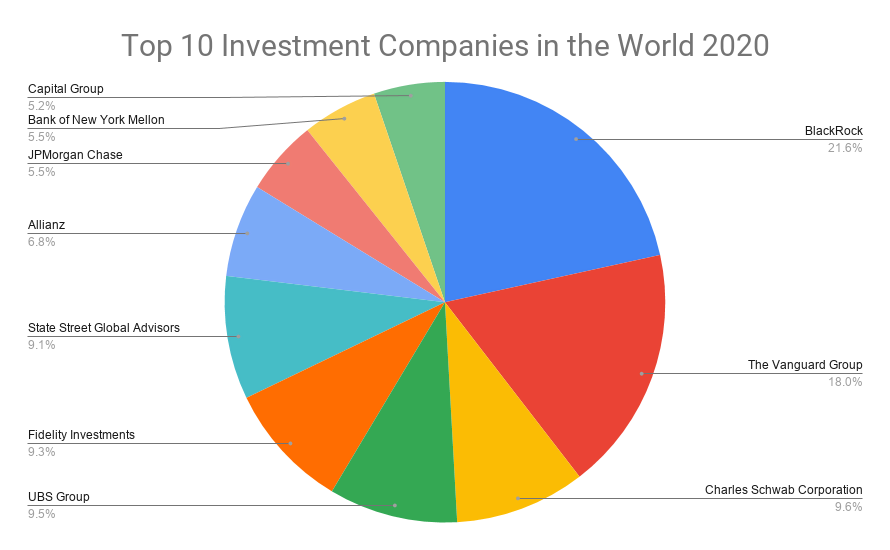

Banks An investment firm is a banks mostly engaged in holding, taking care of and spending safety and securities. These companies in the USA are regulated by the U.S. Stocks and Exchange Compensation and have to be registered under the Investment Firm Act of 1940. Financial investment business spend cash in behalf of their clients that, in return, share in the revenues and losses.

Investment firm do not include brokerage companies, insurer, or financial institutions. In United States securities regulation, there are at the very least 5 kinds of investment business: Generally, each of these investment firm need to register under the Stocks Act of 1933 and the Investment Firm Act of 1940. A 4th and lesser-known kind of investment firm under the Investment Firm Act of 1940 is a Face-Amount Certificate Firm.

A significant sort of firm not covered under the Financial Investment Company Act 1940 is private financial investment firms, which are simply personal business that make financial investments in stocks or bonds, but are restricted to under 250 financiers and are not managed by the SEC. These funds are often made up of extremely affluent capitalists.

Regulated funds generally have constraints on the kinds and quantities of investments the fund manager can make. The majority of financial investment firms are shared funds, both in terms of number of funds and assets under management.

Investment Company in Temple

The first investment company were established in Europe in the late 1700s by a Dutch trader who intended to make it possible for tiny investors to pool their funds and diversify. This is where the concept of financial investment companies stem, as mentioned by K. Geert Rouwenhorst. In the 1800s in England, "financial investment merging" emerged with counts on that appeared like modern-day mutual fund in framework.

The 1929 stock exchange crash and Excellent Anxiety temporarily hindered investment funds. However new protections guidelines in the 1930s like the 1933 Securities Act recovered capitalist self-confidence. A variety of technologies after that led to stable development in financial investment firm assets and accounts over the years. The Investment Firm Act of 1940 manages the framework and operations of investment firm.

In 1938, it authorized the creation of self-regulatory companies like FINRA to supervise broker-dealers. The Stocks Act of 1933 needs public safeties offerings, including of investment firm shares, to be registered. It also mandates that investors receive a present program explaining the fund. "Investment Companies". United State Stocks and Exchange Commission (SEC).

Mineral Rights Companies around Temple, Texas

Lemke, Lins and Smith, Law of Investment Firm, 4.01 (Matthew Bender, 2016 ed.). Chaudhry, Sayan; Kulkarni, Chinmay (2021-06-28). "Design Patterns of Spending Apps and Their Impacts on Investing Actions". ACM. pp. 777788. doi:10.1145/ 3461778.3462008. ISBN 978-1-4503-8476-6. "Investment Clubs and the SEC",, Customized January 16, 2013. (PDF). Financial Investment Firm Institute. 2023.

In retail mutual fund, countless financiers may be included through intermediaries, and they may have little or no control of the fund's tasks or expertise regarding the identities of other capitalists. The possible variety of financiers in a private mutual fund is generally smaller sized than retail funds. Exclusive financial investment funds often tend to target high-net-worth individuals, consisting of politically revealed individuals, and fund supervisors might have a close relationship with their client capitalists.

Passive funds have actually been expanding in their market share, and in some territories they hold a substantial portion of ownership in openly traded companies. There are several categories for investment funds. As an example, some are closed-end, meaning they have a set variety of shares or funding, whilst others are open-end, implying they can turn into unlimited shares or resources.

The prices, risk, and terms of derivatives are based on a hidden possession, and they permit investors to hedge a setting, increase utilize, or guess on a possession's change in value. A financier might own both a supply and an alternative on the very same supply that enables them to sell it at a set cost; therefore, if the supply's rate drops, the option still retains value, decreasing the financier's losses.

Whilst considered, offered the emphasis of this instruction on the robot of corporate automobiles, a complete treatment of the beneficial possession of assets is outside its extent. A mutual fund works as a channel to take advantage of several properties being held as investments. Capitalists can be people, corporate lorries, or institutions, and there are normally a number of intermediaries in between the financier and mutual fund in addition to in between the mutual fund and the underlying financial possessions, especially if the fund's devices are exchange-traded (Box 1).

Investment Firms local to Temple, Texas

Depending on its legal form and structure, the people exercising control of a mutual fund itself can differ from the individuals who possess and take advantage of the underlying properties being held by the fund at any offered moment, either directly or indirectly. Both retail and exclusive financial investment funds normally have fund managers or advisors who make financial investment choices for the fund, choosing safety and securities that align with the fund's objectives and run the risk of resistance.

and act as intermediaries in between financiers and the fund, helping with the trading of fund shares. They link investors with the fund's shares and carry out professions on their behalf. handle the enrollment and transfer of fund shares, keeping a document of investors, refining possession modifications, and releasing proxy products for shareholder meetings.

Navigation

Latest Posts

Landscape Designer

Landscape Design

Landscape Design Services